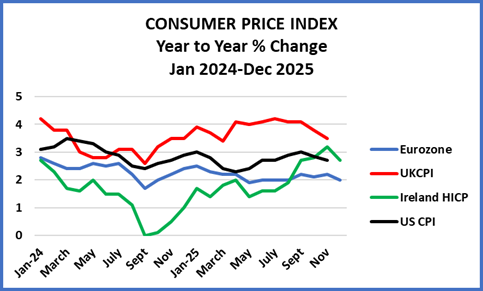

The Irish Consumer Price Index, the measure favoured by the CSO, and more generally quoted, recorded an increase of 2.8% which was a welcome decline from November’s high of 3.2%. Food inflation continued, but it was offset by a decline in energy prices. It means inflation for he year was 2.2%.

In the US the figure for inflation in December was 2.7% – the same as the previous month. It seems to be taken as a positive sign that inflation is heading downwards. As the latest unemployment figures show an increase, the odds are on further cuts in the Fed interest rate after 0.25% cuts earlier in December and also September and October.

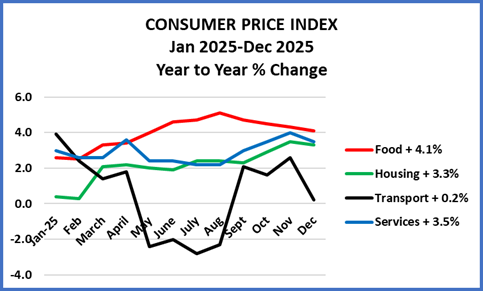

The second graph shows some detail on the Irish CPI for the period to December. Food inflation remains strong but the other major categories showed declining rates of inflation.

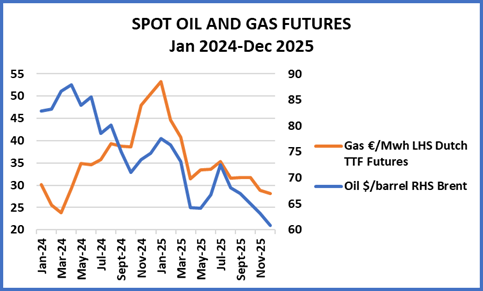

Oil and gas are critically important commodities and major influences on prices. In most of 2024, gas had been increasing in price while oil had been falling. But since the start of 2025 prices of both have been falling. This continued into last December. The US intervention in Venezuela seems likely to accentuate the downward trend – unless it sparks a general rise in international tensions. Generally, oil and gas supplies are relatively abundant and demand sluggish because of slow growth in Europe and the far east.

Unless noted to the contrary all graphs are based on CSO statistics.