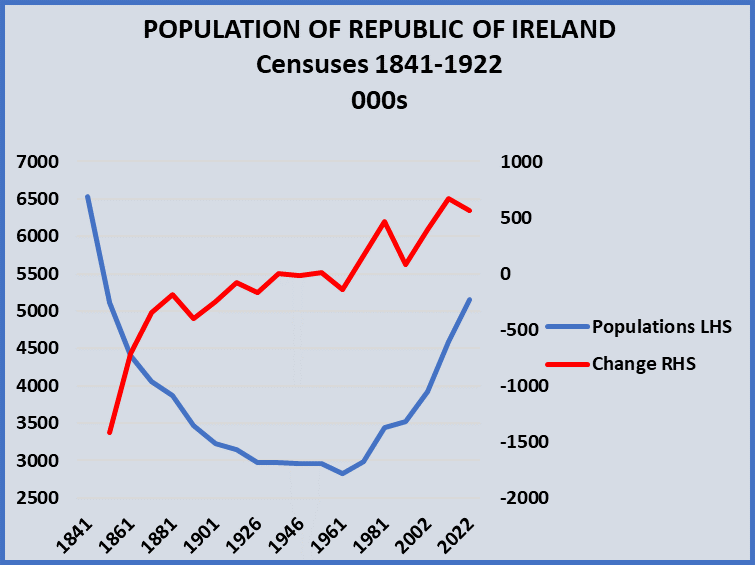

Dramatic Demographics: Ireland’s Rapid Population Growth

Recent data from the CSO gives the Irish population at 5.5 million in April 2024 up by 41% since 2001. This is a very rapid rate of population growth. By contrast EU population grew by 5% in the same period. Migration is the key factor and has provided 54% of the total. As is to be expected migration likely also accounts for a high proportion of the increase in jobs. In the year to April 2024 net migration of over 25 year olds, presumably mostly coming to work, was the same as the total increase in employment - 50,000. Over the time since 2001 this age cohort of migrants was equal to about 54% of the increase in employment and suggests about half of employment growth is accounted for by migrants.

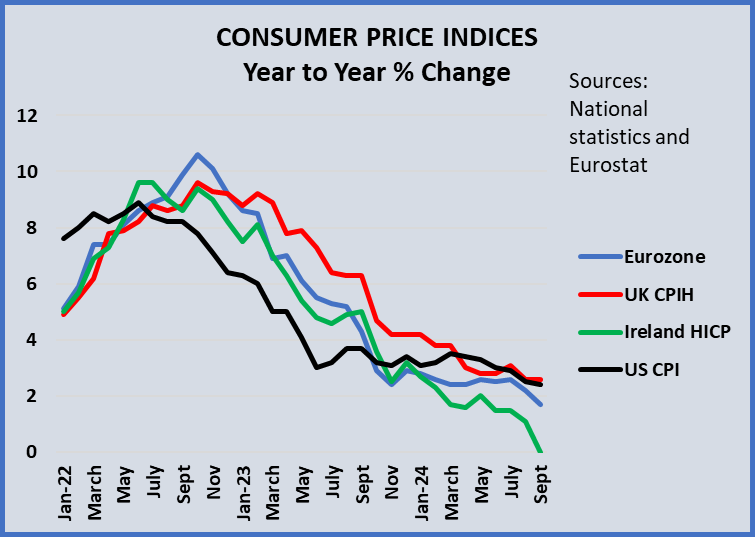

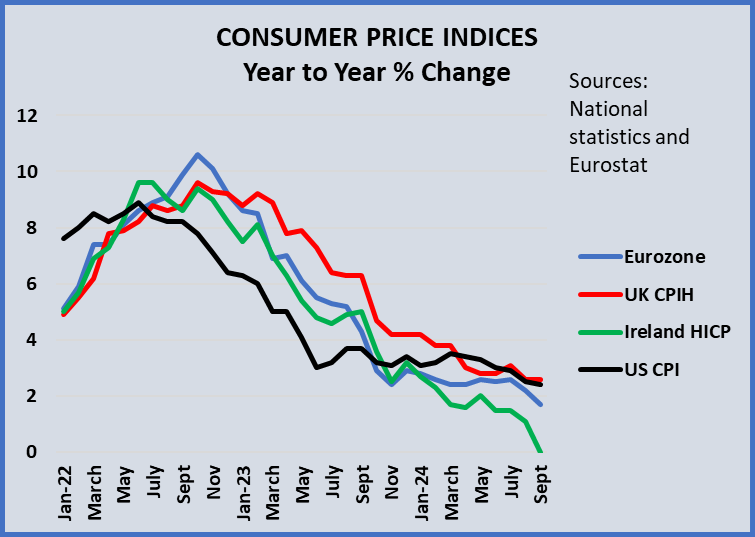

Inflation: Moderating Trend

Year to year inflation in the EU dropped to 1.9% in May, just below the target, and seemingly vindicating the ECB's series of interest rate cuts. The situation in the US is not so clear since inflation is appreciably above 2%, the economy is running hot and there are uncertain implications for prices in the President's tariff policy. For the moment the Federal Reserve is holding its hand. In Ireland inflation increased from 2% to 2.2% n April driven by prices for food and services, especially hospitality . But the flash estimate for May is a decline. Considering demand brisk and unemployment low the economy has done well to record a moderation in price increases. A small decline in US inflation in April was a positive feature. But the possibility of price increases resulting from US tariff policy, has pushed expectations the other way. It seems unlikely that interest rates will be cut in the US anytime soon. Meanwhile, in Europe things are moving in the opposite direction with inflation falling and the economy still weak.

After Dramatic First Quarter, Production Drops Back.

The indicators for the first quarter suggest rapid growth up to March powered mainly by production and exports from US companies aiming to beat the deadline set by the Trump administration for the imposition of tariffs. In the event the threat did not materialise but the data for from trade, and indices of industrial production in April indicate that there was a sharp drop in activity after the initial burst. On the other hand the AIB purchasing managers index suggests that April and May showed growth in manufacturing. Also, unemployment continued to fall in April and May. It remains to be seen if May trade and industrial production will recover back to trend or stay at currently depressed April levels.