Latest Economic Forecasts

With slow growth in Europe, China and the UK, 2023 recorded a sharp slow down in the Irish economy with GDP falling by over 3% and Modified Domestic Demand (a measure which excludes the effects of multinationals) .

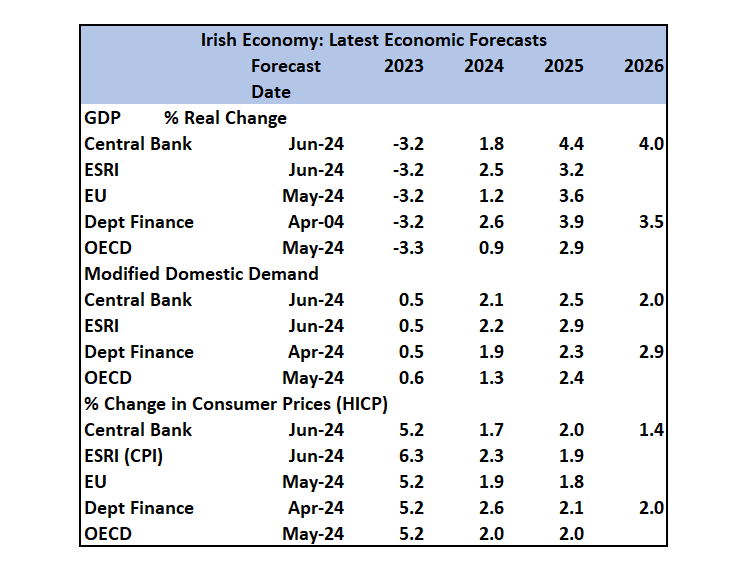

The attached table shows the latest forecasts for Ireland made by various organisations. They all project a turnaround in 2024 from the poor growth of 2023 (whether measured by GDP or Modified Domestic Demand) and they all project something around 2% real growth in MDD. For 2025 things are projected to get better with growth rates in MDD about 0.5% points higher than expected for 2024. For 2026 the Central Bank and the Department of Finance offer slightly contrasting views with resect to MDD and GDP. In summary, the prospetcs are relatively modest – by past Irish standards.

With respect to inflation, there is agreement that the prospects are encouraging. Whether measured by the EU’s Harmonised Index of Consumer Prices (HICP) or our own Consumer Price Index (CPI), inflation is expected to be dramatically lower this year than last and to continue to be subdued in 2025 and 2026.