Irish Inflation Continues to Edge Down

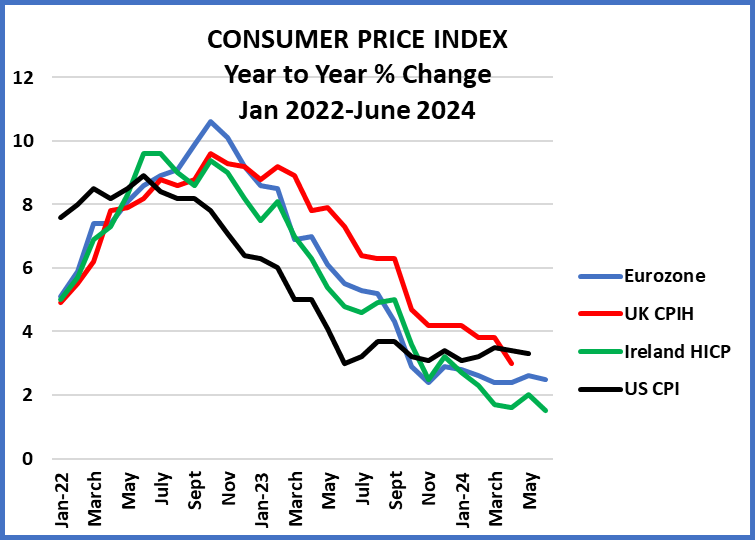

The ‘flash’ estimate of inflation for June released by the CSO and Eurostat recently show inflation edging downwards in Ireland and the Eurozone. The Irish rate, using Eurostat’s measure of inflation, was 1.5% up on June 2023 compared with 2% in May and 2.5% in the EU.

In this context the ECB cut its rate by 0.25% in June. But the official view that further cuts would depend on inflation and that is still above the target of 2%.

The situation in the US is not so encouraging. The rate was 3.3% in May slightly below the rate in April but showing no real decline over the first five months of the year. The cause of US inflation is the buoyant economy. At its June meeting the Fed was not impressed. It is thought that maybe one cut in rates might be expected for the rest of this year.

The ‘flash’ estimates of inflation cited above are compiled on the basis of Eurostat’s Harmonised Index of Consumer Prices (HICP). This is much lower than the Irish Consumer Price Index (CPI) mainly because it excludes some housing costs. The Irish CPI came out at 2.6% in May the same as in April but trending down over the first months of 2024.

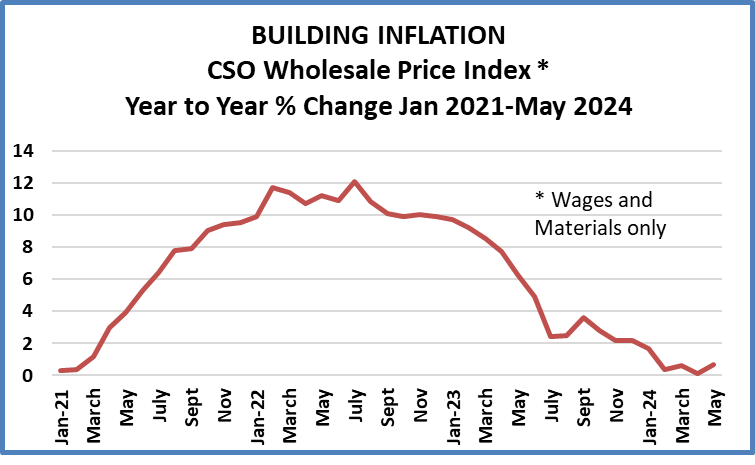

One area in which inflation has dramatically relented is in building and construction. The second graph shows the CSO’s Wholesale Price Index for construction. It includes wages and materials only. After peaking in the middle of last year it dropped to virtually nil in recent months.

The third graph is based on the national accounts where there is a break down of building investment in real and current money terms. These amounts cover wages and salaries as in the graph above, but also builders’ margins and so is much more comprehensive. (For some reason this measure is rarely if ever cited). It shows the same trend as the CSO graph but up to the first quarter of this year there was still some inflation left in the sector.

The general opinion among Irish macro forecasters is that inflation has been quite resilient in some sectors, especially the hospitality sector with services as a whole running at 5% inflation in recent months. But overall, a halving, at least, in the rate of annual inflation is expected in 2024 compared with last year.

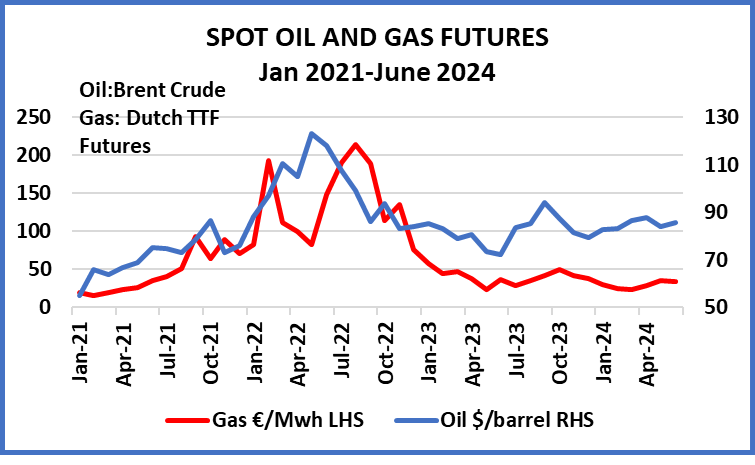

Going through the summer, it is worth a look at the situation in the commodity markets for gas and oil. The very latest data shows an increase in oil and a decline in gas commodity prices. Obviously with two wars in progress, and the possibility that one might spread to the Persian Gulf, and a tightly balanced market in gas, sustained increases are always possible. But so far so good for prices at the consumer level at least.