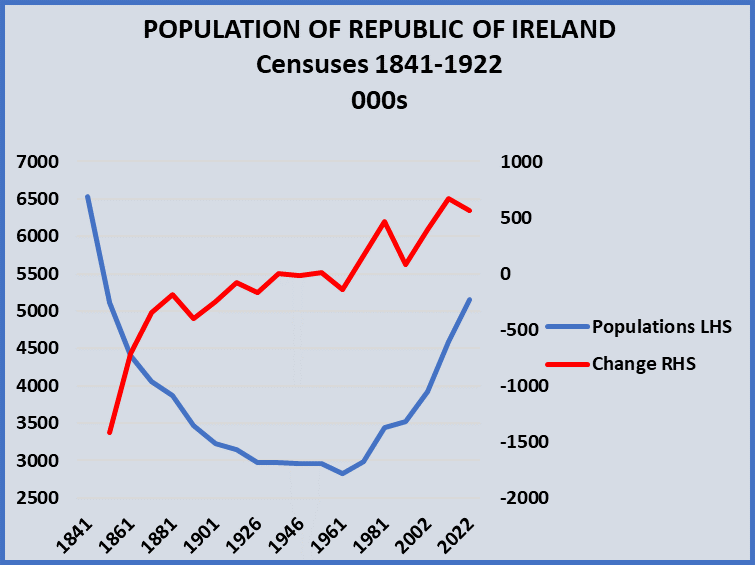

Dramatic Demographics: Ireland’s Rapid Population Growth

Recent data from the CSO gives the Irish population at 5.5 million in April 2024 up by 41% since 2001. This is a very rapid rate of population growth. By contrast EU population grew by 5% in the same period. Migration is the key factor and has provided 54% of the total increase. As is to be expected migration likely also accounts for a high proportion of the increase in jobs. In the year to April 2024 net migration of over 25 year olds, presumably mostly coming to work, was the same as the total increase in employment - 50,000. Over the time since 2001 this age cohort of migrants was equal to about 54% of the increase in employment and suggests about half of employment growth is accounted for by migrants.

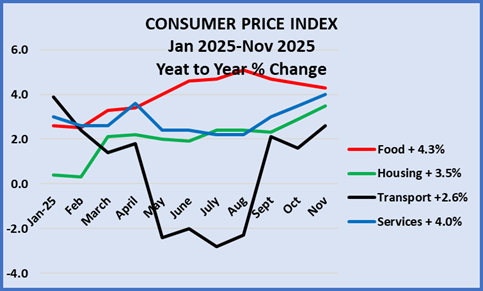

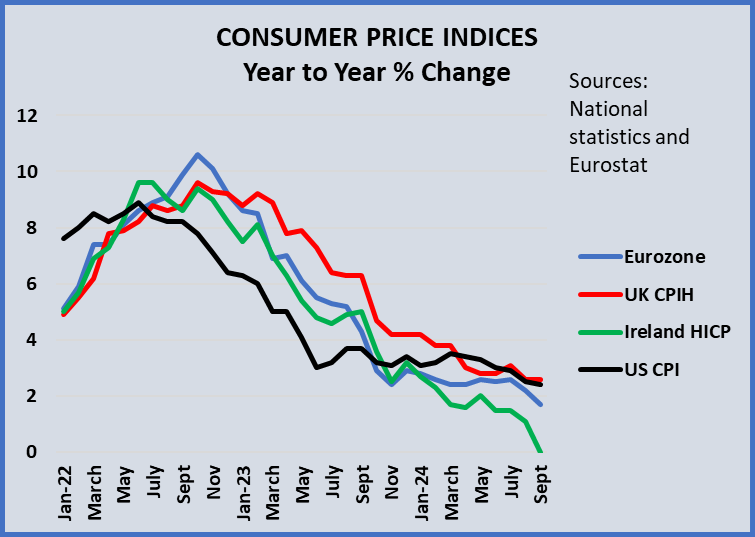

Inflation: Irish Index Declines

Year to year inflation in Ireland, as measured by the Consumer Prices fell from 3.2% in November to 2.8% in December. For the EU the fall was from 2.2% to 2% bringing the index into line with the ECB's target. For Ireland the main lowering influence was weaker energy prices but food price inflation remained strong,

GDP Edges Down in Fourth Quarter – Stays Well Ahead of 2024 Levels.

After a rapid increase in output and exports in the first quarter, caused by the stampede to get product into the US before the Trump tariffs, activity declined only slightly in the next three quarters. The preliminary figures for the fourth quarter show a slight dip on the third quarter., but a 6.7% increase on the level in the corresponding quarter of 2024. It means that GDP rose by 12.6% in 2025. Modified Domestic Demand, a measure of activity with the international sector removed, advanced by 2.3% in the third quarter and is now up 5.3% on year ago levels. In summary, output in the nine months of 2025 was running 13.2% ahead of the average for 2024 while for MDD the corresponding figure was 3.8%.